Is it mandatory to have life insurance with a mortgage

You’re not legally obliged to get life insurance for a mortgage, but some lenders may consider it a precondition for letting you borrow money to buy a home. For the vast majority of homeowners, having financial protection in place makes sense.

- Does life insurance cover my mortgage?

- Is it compulsory to have life insurance with a mortgage UK?

- Is mortgage life insurance the same as life insurance?

- Do I need life insurance after my mortgage is paid off?

- How does mortgage insurance work in case of death?

- Can I cancel my mortgage life insurance?

- How much is mortgage life insurance monthly?

- Is mortgage protection cheaper than life insurance?

- Do I need life insurance if I have no family?

- Do I get my money back if I cancel life insurance?

- Can I lower my life insurance policy?

- Can you have more than 1 life insurance policy?

- What debts are forgiven at death?

- Do mortgage lenders check all bank accounts UK?

- Why would Natwest decline mortgage?

- What do Natwest need for mortgage?

- At what age should you stop having life insurance?

- Do I need life insurance if I have a lot of savings?

- Why should single people have life insurance?

- What is better term or whole life?

- Can I sell my life insurance policy for cash?

- What happens if you live longer than your term life insurance?

- What happens if I don't pay my whole life insurance premiums?

Does life insurance cover my mortgage?

Life insurance pays out money if you die during the term of the policy, and mortgage life insurance is a particular type to clear any debt outstanding on your home loan. … Any claim on ordinary life insurance could also be used towards a home loan, but the mortgage version is specifically tailored for this.

Is it compulsory to have life insurance with a mortgage UK?

Life insurance for your mortgage is not compulsory – but it is highly recommended for most people. Mortgage providers can insist you have life insurance in place, but they cannot force you to have their insurance.

Is mortgage life insurance the same as life insurance?

Both types of insurance can be used to help your loved ones pay off the mortgage. The main difference between life insurance and mortgage life insurance is that they are designed with different protection purposes in mind.Do I need life insurance after my mortgage is paid off?

Most mortgage lenders require house buyers to take out life insurance so their families can cover costs if they pass away. If you have no dependants however, you probably don’t need to worry about life insurance when you buy a home. … At which point, it’s best to opt for funeral insurance.

How does mortgage insurance work in case of death?

Rather than paying out a death benefit to your beneficiaries after you die as traditional life insurance does, mortgage life insurance only pays off a mortgage when the borrower dies as long as the loan still exists. … Premiums are either paid separately or are rolled into the borrower’s regular monthly mortgage payment.

Can I cancel my mortgage life insurance?

Can you cancel a life insurance policy at any time? Yes. … It is similar to other insurance products such as car insurance. Types of life insurance that are defined as ‘pure protection’ policies include term insurance, mortgage decreasing life insurance and family income benefit.

How much is mortgage life insurance monthly?

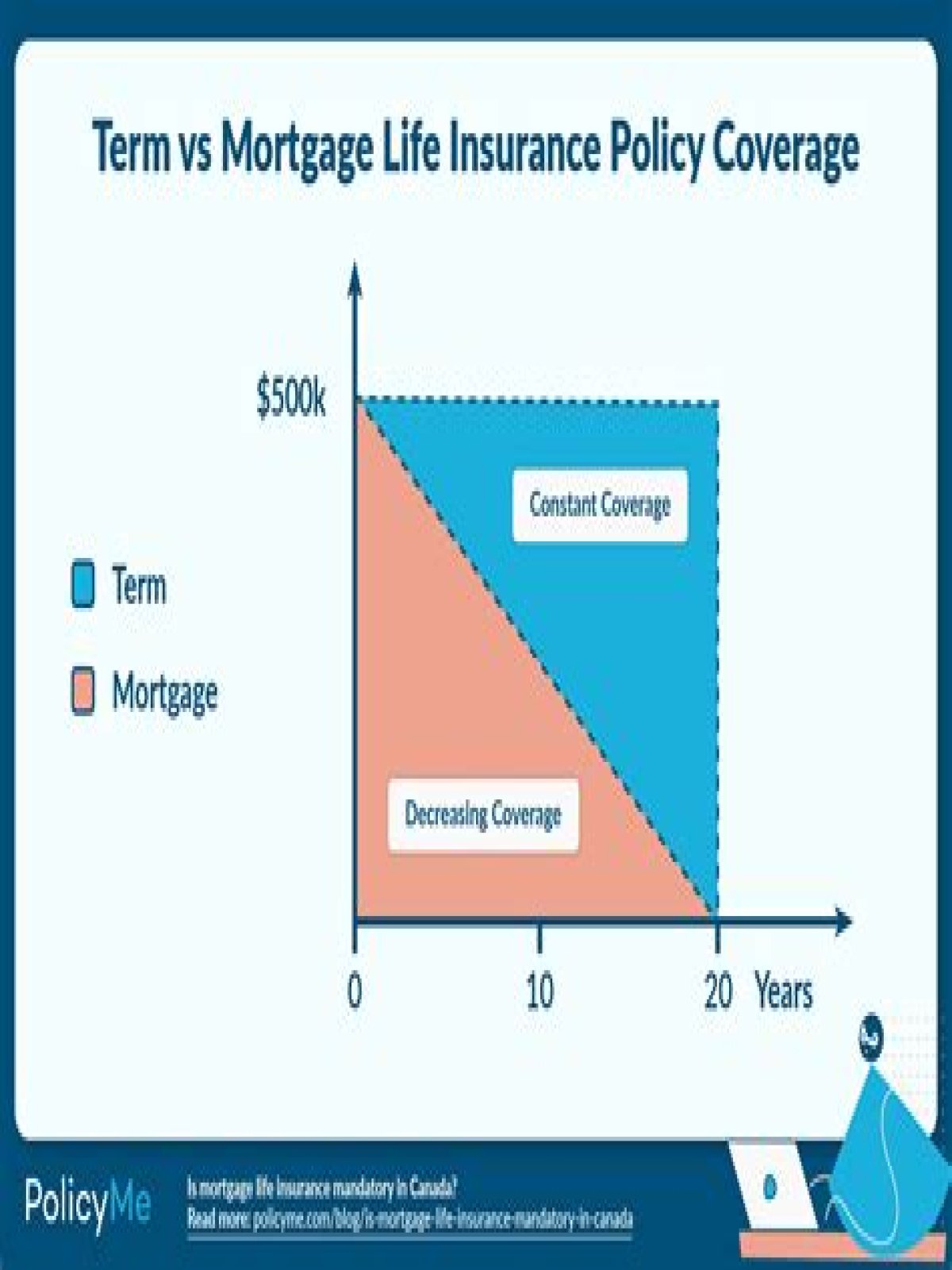

Assuming that’s your mortgage, you would pay roughly $50 a month for a bare minimum policy.” Please keep in mind that with mortgage protection insurance, your coverage amount will decrease over time as you pay toward your mortgage balance.Is mortgage protection cheaper than life insurance?

Whilst price will hugely vary from person to person, and mortgage to mortgage, mortgage protection tends to be cheaper than life insurance as it’s a decreasing risk – the more you pay off over time, the less your pay out will need to be.

Do you need life insurance for a mortgage NatWest?If you’re considering applying for a NatWest mortgage, it’s important to remind you life insurance is not a condition of taking out a mortgage with us. You’re under no obligation to take out life insurance with AIG and your choice will have no impact on our lending decision.

Article first time published onDo I need life insurance if I have no family?

Single people with no children often don’t need life insurance because no one is relying on their income. … If you don’t have life insurance, someone else (e.g., your relatives) may have to foot these bills. Even if you have only a small policy, the death benefits could be used to cover these expenses.

Do I get my money back if I cancel life insurance?

Do I get my money back if I cancel my life insurance policy? You don’t get money back after canceling term life insurance unless you cancel during the free look period or mid-billing cycle. You may receive some money from your cash value if you cancel a whole life policy, but any gains are taxed as income.

Can I lower my life insurance policy?

Reduce the policy’s face amount. Most life insurance companies will allow you to lower the amount of your death benefit in exchange for a lower premium. If you lower the face amount of a permanent life insurance policy enough, your carrier may consider you “paid up” and allow you to stop paying premiums entirely.

Can you have more than 1 life insurance policy?

Yes, you can have more than one life insurance policy. There’s no law that prevents you from having a combination of different life insurance arrangements. But for most people’s circumstances, having one life insurance policy is usually enough.

What debts are forgiven at death?

- Secured Debt. If the deceased died with a mortgage on her home, whoever winds up with the house is responsible for the debt. …

- Unsecured Debt. Any unsecured debt, such as a credit card, has to be paid only if there are enough assets in the estate. …

- Student Loans. …

- Taxes.

Do mortgage lenders check all bank accounts UK?

Yes, a mortgage lender will look at any depository accounts on your bank statements – including checking and savings – as well as any open lines of credit.

Why would Natwest decline mortgage?

Your Natwest mortgage application may be declined by an underwriter due to fraud, failing Natwest’s mortgage affordability checks, due to a poor credit score or due to the mismatch of information on your Natwest mortgage application and your supporting documents.

What do Natwest need for mortgage?

All you need are your mortgage account number, name, date of birth and your postcode.

At what age should you stop having life insurance?

According to financial expert Suze Orman, it is ok to have a life insurance policy in place until you are 65, but, after that, you should be earning income from pensions and savings.

Do I need life insurance if I have a lot of savings?

Even cash value insurance shouldn’t just sit there, however. Not everyone needs life insurance. Those who’ve accumulated enough wealth and assets to care for their own and their loved one’s needs independently in the event of their death can forgo paying for life insurance, especially if it’s a term policy.

Why should single people have life insurance?

You don’t need a family to benefit from life insurance, especially if you’re getting a permanent policy. Life insurance for single people can be a great way to build savings and set yourself up later on in life while also giving you the added bonus of a death benefit to leave to the people you care about the most.

What is better term or whole life?

Term life is “pure” insurance, whereas whole life adds a cash value component that you can tap during your lifetime. Term coverage only protects you for a limited number of years, while whole life provides lifelong protection—if you can keep up with the premium payments.

Can I sell my life insurance policy for cash?

Yes, you can sell your life insurance policy by obtaining a life settlement. The process of obtaining a life settlement involves selling a life insurance policy to a third-party buyer for a cash payout that is more than the policy’s cash surrender value but less than the total face value of the policy.

What happens if you live longer than your term life insurance?

If you outlive your term policy, your policy will end, and you will no longer have coverage. If you still want life insurance after your term policy ends, you may have the option to buy a new life insurance policy or consider a term conversion policy.

Term: If you stop paying premiums, your coverage lapses. Permanent: If you have this type of policy, you will have the following choices: Cash out the policy. … You will no longer be covered by life insurance, but you will at least save some of the proceeds of the policy.