What is the difference between an expense and an asset

expenses, we’re referring to anything your company purchases in order to do business. … In order to distinguish between an expense and an asset, you need to know the purchase price of the item. Anything that costs more than $2,500 is considered an asset. Items under that $2,500 threshold are expenses.

- Is an asset an expense?

- Is a laptop an asset or expense?

- Is asset similar to expenses?

- Is printer an asset?

- Is a computer an asset or expense?

- What are the 3 types of assets?

- Is expenses an asset or liability?

- How do you know if something is an asset?

- Is an IPAD an asset or expense?

- Does my computer count as an asset?

- What kind of asset is fire extinguisher?

- Is office furniture an expense or asset?

- Is cash a fixed asset?

- Is cash an asset?

- What are the types of expenses?

- What are the 7 asset classes?

- Are all expenses assets?

- Is telephone an asset or expense?

- What type of asset is a refrigerator?

- Is 401k an asset?

- Is a bank account an asset?

- What are some examples of assets?

- What are four types of expenses?

- What are assets in accounting?

- What's an expense in accounting?

- Is a fridge considered furniture?

- Is a vacuum cleaner a fixed asset?

- Is lighting a fixed asset?

- Are Airpods a business expense?

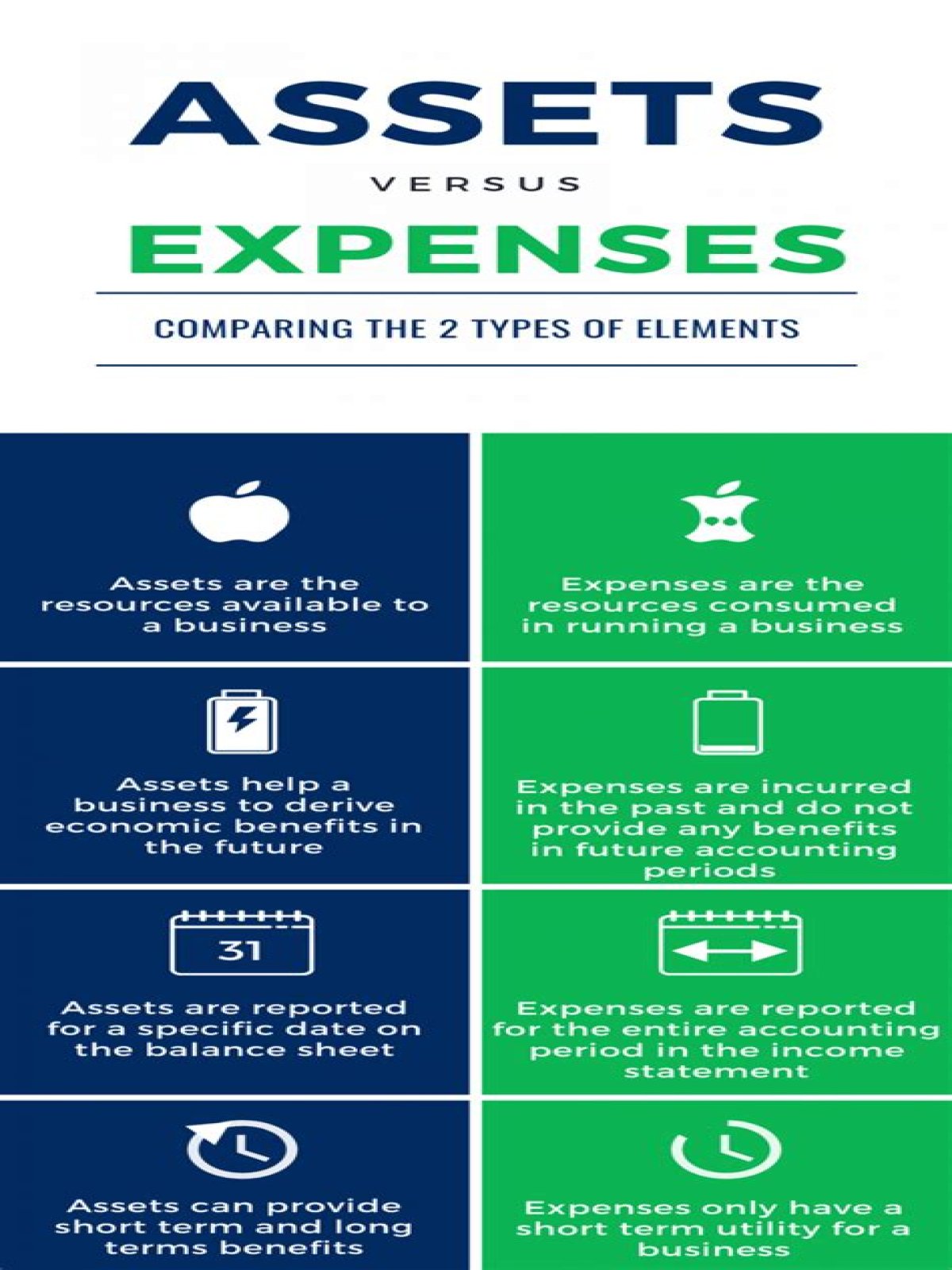

Is an asset an expense?

In double-entry bookkeeping, expenses are recorded as a debit to an expense account (an income statement account) and a credit to either an asset account or a liability account, which are balance sheet accounts. … The purchase of a capital asset such as a building or equipment is not an expense.

Is a laptop an asset or expense?

Anything large that’s integral to the functioning of your business, such as a laptop or camera that can have depreciating value, should be entered as an asset. Small things, such as accessories, should be entered as expenses. … However, both are still assets, because they retain value after a year.

Is asset similar to expenses?

Both assets and expenses have a “debit” balance on your business’s financial statements, but that’s where their similarities end. Spending time on one of these can make you rich, and spending too much on the other can leave you broke. It’s worth it to learn the difference!Is printer an asset?

The cost of a printer is considered an asset and should be reported on the balance sheet. Keep in mind that all expenses associated with printing is also considered and expense. Thus, ink, paper, and repairs to the printer itself are typically considered expenses.

Is a computer an asset or expense?

Examples of fixed assets include tools, computer equipment and vehicles. Fixed assets help a company make money, pay bills in times of financial trouble and get business loans, according to The Balance.

What are the 3 types of assets?

Common types of assets include current, non-current, physical, intangible, operating, and non-operating. Correctly identifying and classifying the types of assets is critical to the survival of a company, specifically its solvency and associated risks.

Is expenses an asset or liability?

Expenses are more immediate in nature, and you pay them on a regular basis. They’re then shown on your monthly income statement to determine your company’s net income. When you don’t pay for an expense, it becomes a liability.How do you know if something is an asset?

Accounting standards define an asset as something your company owns that can provide future economic benefits. Cash, inventory, accounts receivable, land, buildings, equipment – these are all assets. Liabilities are your company’s obligations – either money that must be paid or services that must be performed.

Is Camera an asset?If camera is used in day to day business such as photo studio and is expected to be used for more than 1 year or so then it is a fixed asset whereas for a camera dealer it would be inventory i.e. current asset.

Article first time published onIs an IPAD an asset or expense?

New Rules for Deducting iPads You would expense the tablet under IRS Code Section 179, effectively breaking down the cost deduction over several years.

Does my computer count as an asset?

Computer software can be considered a long-term asset that falls under fixed assets like buildings and land. However, there are times when software should not be considered a long-term asset.

What kind of asset is fire extinguisher?

Yes, Fire Extinguishers are Fixed Assets.

Is office furniture an expense or asset?

While office furniture is a necessary business expense, it is also considered an investment in the company. Because it is an asset, office furniture also qualifies for a 100% bonus depreciation write off.

Is cash a fixed asset?

Fixed assets, which are noncurrent assets, are long-term tangible pieces of property or equipment that a firm owns and uses in its operations to generate income. … Current assets include cash and cash equivalents, accounts receivable, inventory, and prepaid expenses.

Is cash an asset?

Current assets are assets that can be converted into cash within one fiscal year or one operating cycle. Current assets are used to facilitate day-to-day operational expenses and investments. Examples of current assets include: Cash and cash equivalents: Treasury bills, certificates of deposit, and cash.

What are the types of expenses?

There are three major types of expenses we all pay: fixed, variable, and periodic.

What are the 7 asset classes?

- Domestic Equities.

- Global Equities.

- Currency.

- Bond/Fixed Income.

- Commodities:

- Real Estate.

Are all expenses assets?

expenses, we’re referring to anything your company purchases in order to do business. … In order to distinguish between an expense and an asset, you need to know the purchase price of the item. Anything that costs more than $2,500 is considered an asset. Items under that $2,500 threshold are expenses.

Is telephone an asset or expense?

Car is which: asset, liability, revenue, expenseAssetElectricity bill is which: asset, liability, revenue, or expense?ExpenseLoan to a friend is which: asset, liability, revenue, or expense?AssetTelephone bill is which: asset, liability, revenue, or expense?Expense

What type of asset is a refrigerator?

Yes, a refrigerator would be a fixed asset. A fixed asset is one purchased for the long-term operation of a business and is held over the course of…

Is 401k an asset?

Retirement funds: Retirement accounts such as your 401(k), IRA, or TSP are considered assets. Vehicles: Although your vehicle is considered an asset, it’s normally considered a depreciating asset.

Is a bank account an asset?

An asset is something you own that has monetary value, like a house, car, checking account or stock.

What are some examples of assets?

- Cash and cash equivalents.

- Accounts receivable (AR)

- Marketable securities.

- Trademarks.

- Patents.

- Product designs.

- Distribution rights.

- Buildings.

What are four types of expenses?

- Variable expenses. Expenses that vary from month to month (electriticy, gas, groceries, clothing).

- Fixed expenses. Expenses that remain the same from month to month(rent, cable bill, car payment)

- Intermittent expenses. …

- Discretionary (non-essential) expenses.

What are assets in accounting?

An asset is a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit. Assets are reported on a company’s balance sheet and are bought or created to increase a firm’s value or benefit the firm’s operations.

What's an expense in accounting?

An expense is the cost of operations that a company incurs to generate revenue. As the popular saying goes, “it costs money to make money.” Common expenses include payments to suppliers, employee wages, factory leases, and equipment depreciation.

Is a fridge considered furniture?

Since refrigerators have a useful life that is more than a year, you may include it under Furniture, Fixtures and Equipments as long as it is categorized to a Fixed Asset account type. … However, Office and Classroom Furnitures such as desks, chairs or cabinets are also not considered as office supply items.

Is a vacuum cleaner a fixed asset?

Capitalisation is the decision and process of recording a purchase as a Fixed Asset in the business records. … On the other hand, a business might buy a vacuum cleaner for £200, which will probably last several years, but would usually be classed as an Expense because the value is too low to capitalise as Fixed Asset.

Is lighting a fixed asset?

Common fixed asset fixtures are installed lighting, sinks, faucets and rugs. Your copy machines, telephones, fax machines and postage meters are included as office equipment fixed assets.

Are Airpods a business expense?

Under IRS Code, any expense that’s ordinary and necessary for that business is deductible, and would typically include related telecommunications equipment like a Bluetooth or headphones and mic for those important business calls.