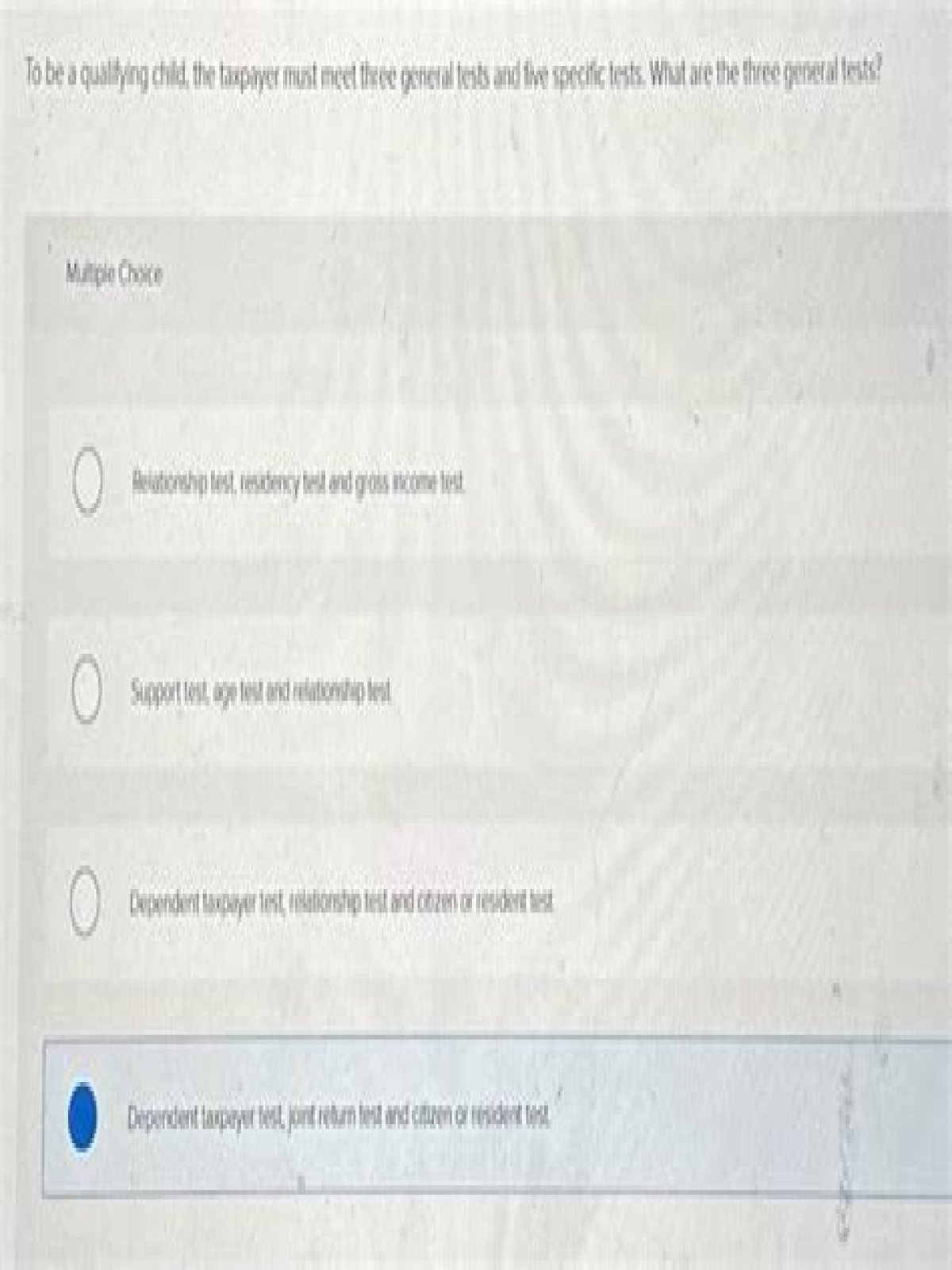

What are the three general tests that a qualifying person must meet to be a dependent of the taxpayer?

Feedback: To be a dependent of the taxpayer, a qualifying child and a qualifying relative must meet the three general tests: dependent taxpayer test, joint return test and citizen or resident test.

Table of Contents

- What are the 3 requirements for the IRS to consider someone a Dependant?

- What are the tests for claiming a dependent?

- What are the three tests a qualifying child?

- Which of the following criteria is necessary to qualify as a dependent of another taxpayer?

- Tax Talk- Dependents- qualifying child and qualifying relative

- What qualifies someone as a dependent?

- Who qualifies as a qualifying relative?

- What are the rules for a qualifying child?

- When claiming dependents they must meet the following criteria except?

- Who all meets the relationship test?

- What is a dependent Do you have any dependents quizlet?

- Can I claim my girlfriend as a dependent?

- Can you claim your boyfriend as a dependent?

- Can I claim someone as a dependent?

- Can my boyfriend claim my son on his taxes?

- Who can claim a child as a dependent?

- Can I claim my adult child as a dependent?

- Can you claim a dependent if they don't live with you?

- Can I claim my child as a dependent if they are over 18?

- Which of the following is a requirement to claim a dependent quizlet?

- What are dependents quizlet?

- What are exemptions quizlet?

- What is the support test?

- How do you determine dependent support?

- How do you prove you support a dependent?

What are the 3 requirements for the IRS to consider someone a Dependant?

To claim your child as your dependent, your child must meet either the qualifying child test or the qualifying relative test: To meet the qualifying child test, your child must be younger than you and either younger than 19 years old or be a "student" younger than 24 years old as of the end of the calendar year.What are the tests for claiming a dependent?

5 Tests To Claim a Dependent On Your Tax Return

- Support Test. ...

- Gross Income Test. ...

- Member of Household Relationship Test. ...

- Joint Return Test. ...

- Citizen/Residency Test.

What are the three tests a qualifying child?

The five dependency tests – relationship, gross income, support, joint return and citizenship/residency – continue to apply to a qualifying relative. A child who is not a qualifying child might still be a dependent as a qualifying relative.Which of the following criteria is necessary to qualify as a dependent of another taxpayer?

Which of the following criteria is necessary to qualify as a dependent of another taxpayer? Must be considered either a qualifying child or relative.Tax Talk- Dependents- qualifying child and qualifying relative

What qualifies someone as a dependent?

The IRS defines a dependent as a qualifying child under age 19 (or under 24 if a full-time student) or a qualifying relative who makes less than $4,300 a year (tax year 2021). • A qualifying dependent may have a job, but you must provide more than half of their annual support.Who qualifies as a qualifying relative?

Live with you the entire year (365 days) or be one of these: Your child, stepchild, foster child, or a descendant of any of them. Your brother, sister, half brother, half sister, stepbrother, or stepsister or a descendant of any of them. Your father, mother, grandparent, or stepparent, but not a foster parent.What are the rules for a qualifying child?

IRS Qualifying Child Requirements

- Under the age of 19 on the last day of the tax year (Dec. 31) and younger than you (and your spouse if filing jointly).

- A full-time student under the age of 24 on the last day of the tax year (Dec. ...

- Permanently disabled at any time during the year, regardless of their age.